ECONOMIA

12-01-2021 by redazione

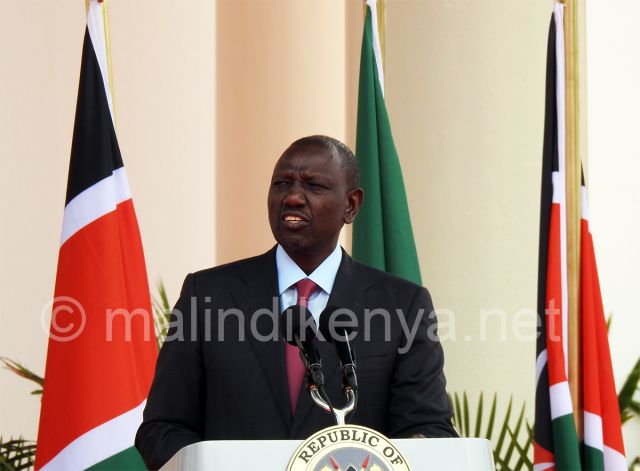

Ten international countries that are part of the so-called "Paris Club of Creditors", which also includes Italy, have decided to suspend Kenya's debt until next 30 June, after President Kenyatta had presented his creditors with a request to suspend service citing a number of reasons derived from the Covid-19 pandemic that has seriously damaged the country's economy.

The 10 countries that Kenya owes money to, apart from Italy, include Belgium, Canada, Denmark, France, Germany, Japan, Republic of Korea, Spain and the United States of America.

"The Government of the Republic of Kenya is committed to dedicate the resources released by this initiative to increase spending to mitigate the health, economic and social impact of the Covid-19 crisis," reads part of the statement. "Kenya is also committed to seeking debt service treatment from all other official bilateral creditors that is in line with the agreed term sheet.

In fact, 12 other countries have agreed to give the country more time to repay 69 billion Kenyan shillings in debt. They are Australia, Austria, Brazil, Finland, Ireland, Israel, the Netherlands, Norway, the Russian Federation, Sweden, Switzerland and the United Kingdom.

The total of 22 creditors decided to come to Kenya's aid after it reversed its decision to join the G20's international policies.

Only China, among the large creditors, and Kenya's largest, rejected Kenya's request, criticising the country's decision to join the G20 only to be able to access the Debt Service Suspension Initiative.

The Paris Club is one of the most important multilateral fora in which the issue of foreign debt, and more precisely its restructuring, is discussed. Set up in 1956 to deal with a financial-debt crisis in Argentina, the Paris Club today brings together 19 states that are the main creditors of the most heavily indebted poor countries and constitutes an important forum for meetings and negotiations between the participating countries. Used as a supranational instrument for negotiations between public creditors, such as governments, and debtors, the Club has personally overseen all recent agreements involving sovereign default. It meets periodically to consider the specific debt situation of a particular country. Since 1956, the Club has carried out some 429 debt restructurings for some 90 countries. From 1983 to December 2013, the Club restructured debts amounting to more than USD 573 billion.

The difficult period for the Kenyan economy may have reached its climax and now begin its downward...

NEWS

by redazione

For those arriving in Kenya in the coming days, a cakewalk. For those living there and particularly Kenyan...

ECONOMICS

by Freddie del Curatolo

Kenya is no longer at risk of economic default. At least that is the authoritative view of its first...

ECONOMY

by redazione

According to the research "Africa Risk-Reward Index"published by Nkc African Economics, Kenya and Ethiopia are the leading countries of the near future in the Black Continent.

The report, which compares investment, GDP, security and many other factors supporting the economy,...

NEWS

by redazione

North coast of Kenya, from Magarini in Kilifi back in anguish for closing water taps by the Coast Water Service Board, which administers the central Baricho water from which almost all of the water supply to the County of Kilifi....

ECONOMIC

by redazione

"Don't lend Kenya any more money!"

The heartfelt and seemingly...

POLITICS

by Freddie del Curatolo

His name is George Wajackoyah and he is one of the four candidates for Kenya's presidency in the upcoming...

An end to the curfew from...

ECONOMIC

by redazione

Five million Kenyans are unable to pay their debts to the banks or credit institutions they...

SPECIAL

by redazione

Ten days before the national elections on 9 August, Kenyans and the country's various productive sectors are...

China's harsh stop to Kenya's lending.

The government in...

ECONOMY

by redazione

The World Economics Journal recently considered the devaluation of the Kenyan Shilling and considered that the currency of Kenya will remain at low values, compared to the dollar and euro, for at least 4 months.